Container traffic within Asia is flying according to trade statistics, but carriers are yet to feel the benefit.

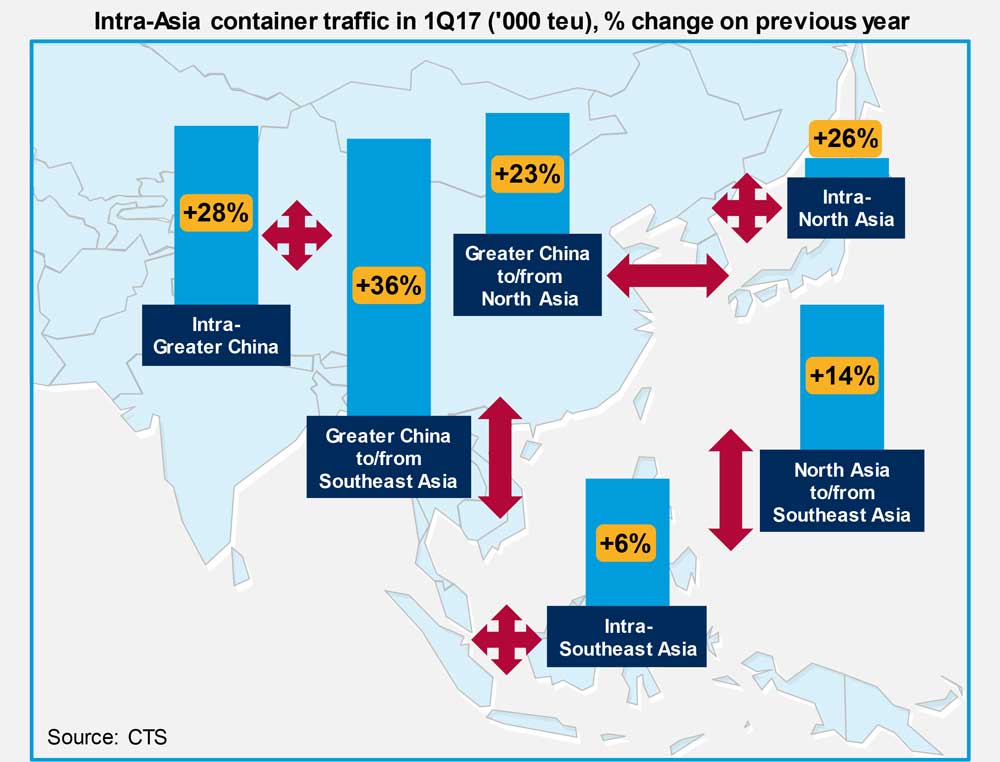

Container traffic surged ahead in the first quarter by an estimated 10% thanks in large part to a rapid escalation in intra-regional volumes, particularly within Asia.[ds_preview] The provisional 1Q17 trade lane data from Container Trades Statistics (CTS) indicates that container trade within Asia (encompassing Greater China, North Asia and Southeast Asia) jumped by a prodigious 23.5% year-on-year to reach 10.8 mill. TEU. This follows on from zero growth in 2016 when Intra-Asia box volumes closed on 39.2 mill. TEU, according to Drewry.

The busiest and fastest growing lane within Intra-Asia is Greater China to/from Southeast Asia, which grew by a staggering 36% to 3.4 mill. TEU. Conditions look set for the two-way trade between Greater China and Southeast Asia to continue to take a bigger slice of the container pie, even if the rapid growth rates settle down.

The busiest and fastest growing lane within Intra-Asia is Greater China to/from Southeast Asia, which grew by a staggering 36% to 3.4 mill. TEU. Conditions look set for the two-way trade between Greater China and Southeast Asia to continue to take a bigger slice of the container pie, even if the rapid growth rates settle down.

The IMF’s World Economic Outlook report, updated in April, predicts that the economies of China, Vietnam, Malaysia and Indonesia will all consistently see GDP growth in the region of 6% per annum over the next five years. In contrast, the outlook in the more mature North Asia region is far more muted with South Korea expected to hover at 3% growth now until 2022, while Japan is forecast to bumble along at below 1% pa.

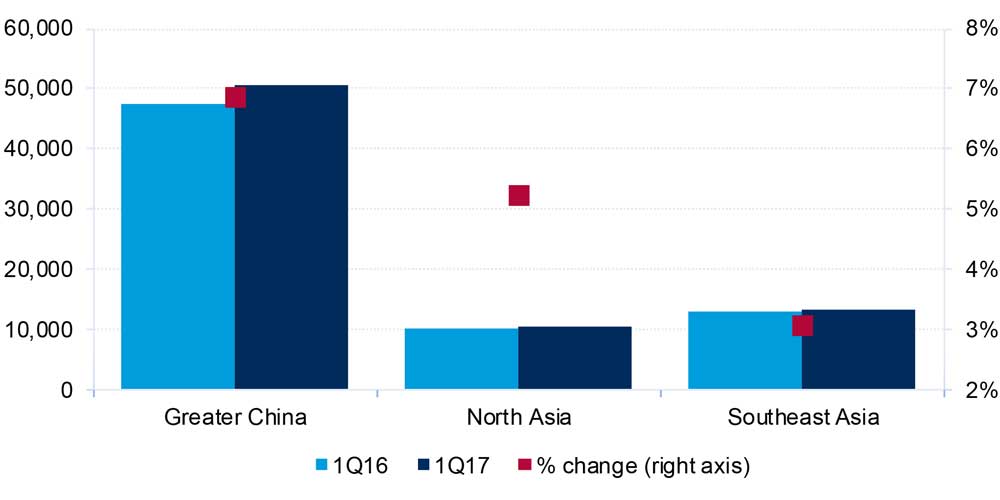

Any retrospective downwards revision would be hard pressed to alter the underlying story that container growth currently resides in the regional trades to a far greater extent that it does in the deep-sea markets. The available 1Q17 container throughput statistics for Asia ports indicate far lower overall growth than seen in the Intra-Asia numbers. Greater China ports were up by 7% year-on-year, versus 5% and 3% for the admittedly smaller batch of North Asia and Southeast Asia ports. This implies that the strong Intra-Asia growth is being watered down by trade to and from other regions.

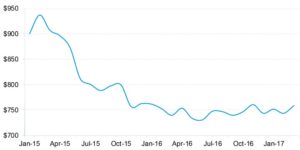

According to Drewry’s Intra-Asia Freight Rate index, average Intra-Asia spot rates are just starting to show the faintest of upwards inflection, but for about 18 months have stubbornly refused to shift much above $750 per 40ft container. At the same time, Intra-Asia specialist carriers Wan Hai and Regional Container Lines both reported operating losses for 1Q17. For Wan Hai, which previously was outperforming its more global rivals in the operating margin stakes, this was only the third quarterly operating loss in five years.

The weakness in Intra-Asia spot rates and disappointing carrier results does not necessarily debunk the demand high-growth story, as per the CTS data. They could merely reflect that as volumes have risen so too have the number and size of containerships being deployed within the trade, leaving the supply-demand balance as it was.

Drewry counts at least eight new Intra-Asia services being launched so far this year with newcomer SM Line at the forefront, while the shrinking idle fleet and resurgence of the charter market is also a sign of renewed demand for ships within Asia.