On the charter market the idle fleet in the Post-Panamax sector remains in short supply resulting in rates continuing on the firming trend. Buyers’ interest in cheap container tonnage increases.

»The argument that the lack of modern sales candidates could lead to buyers competi[ds_preview]ng for older tonnage may well hold water, with a fleet of 12-13 year old 2,500 TEU vessels reportedly seeing very firm numbers. The perceived positive outlook for certain feeder sizes is fuelling the demand from buyers who see asset values cheap enough to justify relatively low earnings in the short term,« a weekly market report by Clarksons Platou says. The analysts have also seen an increase in interest in Panamaxes from buyers looking for cheap tonnage »and it is still to be seen whether an uptick in scrap prices will entice sellers, who have so far been sitting on the fence, to bite the bullet and sell.«

Idle fleet in Post-Panamax sector remains in short supply

This week sees the continued delivery of Charter-owned ULCS into their new tailor-made services, but as expected by Clarksons Platou the real term effect of this on the day-to-day charterer market is muted. As regards chartering activity, Operators are continuing to register interest across all sectors for structural positions at the top end.

»On the other hand, if shorter periods are fixed they tend to be for vessels at the smaller end of the deadweight spectrum where the fluidity of the market prevails. Unsurprisingly therefore, the idle fleet in the Post-Panamax sector remains in short supply resulting in charter rates continuing on the firming trend we have seen over the last few weeks,« the report says, concluding, »It will, however, be some time before we see the same imbalance in the smaller sizes where supply is amply poised to match the demand.«

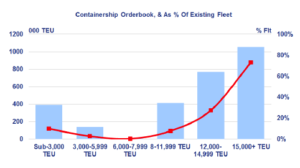

Capacity expands by 1.2 % in first six months

At the start of July, the containership fleet totalled 5,138 vessels of 20.2 mill. TEU, expanding by 1.2 % in capacity terms since the beginning of 2017, according to Clarksons Platou Shipbroking. At the beginning of the month, the boxship orderbook stood at 396 ships of 2.78 mill. TEU, representing a 15 % decline relative to the start of the year in TEU terms, and equivalent to 13.7 % of fleet capacity.

According to latest CTS data, container trade on the Far East-Latin America route totalled 0.27 mill. TEU in May, remaining steady year-on-year. In the first five months of 2017, box trade on this route reached 1.3 mill. TEU, rising 4% year-on-year. Container throughput at the port of Singapore reached 2.8 mill. TEU in June, increasing 9% year-on-year. In the first half of 2017, box handling at the port totalled 16.1 mill. TEU, up 6% year-on-year.