Perfect forecasts of bunker prices are impossible. Nonetheless ship

managers can use advanced techniques including historical comparisons

as basis for rational choice of technology like it is done in other markets.

The key challenge faced by ship managers and operators is cost control. Due to high prices and regulatory requirements, issues[ds_preview] related to bunkers attract the interest of the industry and the academia. Regardless of the issue of sulfur (MARPOL Annex VI, Regulation 14, and Directives 1999/32/EC, 2005/33/EC and 2012/33/EC), the issue of CO2 emissions (IMO, MEPC 62, 2011) and the issue of LNG as marine fuel, the price of marine Heavy Fuel Oil (HFO) and Intermediate Fuel Oil (IFO) has substantially increased in the last years thus increasing voyage costs and draining liquidity. Therefore the monitoring of the development of the prices as well as scientific prediction of the future prices is indispensable for efficient ship management.

The industry is justifiably reserved using scientific techniques for bunker price forecasting. No model can accurately enough predict future values. Definitely no model can take into account price »shocks« that are attributed to political or natural phenomena (e.g. extreme weather conditions) or market sentiment. It is very well known in science »all models are wrong, but some of them are useful«, implying that the complexity of nature and indistinguishably of the markets cannot be precisely represented or translated in a mathematical formulation. This suggests that modeling the phenomenon of bunker price evolution over time is also imprecise and questionably useful.

So, why and how should one devote time and effort in order to predict bunker prices? The answer is simple: scientific forecasting can support rational decisions related to future returns, technology selection and hedging of risks. Business plans need estimation of future prices; estimations based on evidence is better that gut feeling. The selection of a technology, e.g. the selection of a technology for dealing with sulfur emissions, depends on the price difference of High-Sulfur (HS) and Low-Sulfur (LS) bunkers. Low prices of LS bunkers might deem the investment in Exhaust Gas Cleaning Systems (ECGS), i.e. scrubbers) unjustifiable, etc. Finally, the more accurate the forecasting of future prices the more efficient bunker hedging result or strategy.

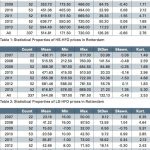

Recent research work aims to bridge the gap between the industry and academic research. In a paper published in 2013 the statistical properties of HS and LS HFO of the Rotterdam prices were presented. An update of this analysis is summarized in the tables 1 to 3 below:

The calculated statistical properties suggest that the mean difference of LS and HS is 29.25$. Considering also the lower standard deviation of the difference (see column StDev of the tables) in comparison to the HS and LS results, one could expect that this value will not substantially fluctuate, meaning that the fluctuation of the difference is less than the fluctuation of HS and LS prices due to an inherent correlation of these time-series. Moreover, the negative skew of the HS and LS time-series vis-à-vis the positive of the difference is also remarkable and should attract the interest of the analysts. Negative skew suggests that the mean is less than the median, while positive skew suggests the opposite. This result, in combination with the higher kurtosis values of the difference, suggests that the distribution of the difference is more »peaky«, i.e. the deviations from the mean are less probable for the time-series of the »difference« among LS and HS prices.

The above analysis of the results does not address the forecasting problem effectively. It is palpable that operators cannot effortlessly draft scenarios that are based or linked to the statistical attributes of these time series. They only reflect the »history« so far and it is like driving with the eyes on the back mirror. Although, forecasting or scenario building on the basis of these time series would be desired and meaningful, it seems that conventional statistics do provide solid foundation for further univariate forecasting. Nonetheless the relatively few observations of the LS time series imply that more advanced models, such as autoregressive ones might not be suitable as well. In the literature there are many works dealing with the issue of small sample properties of estimates of the parameters of autoregressive models, yet experts have not yet explored this aspect.

»It becomes clear, that the

consideration of more ›history‹

improves the results«

Stefanakos and Schinas (2014) recently published a paper that uses advanced statistical methods for the forecasting of future bunker prices. The method considered has been tested and used effectively with environmental data, time-series required for offshore applications. Among its advantages is the inherent estimation of seasonality. The method considers a set of »input« time-

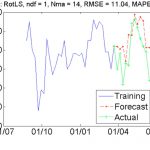

series and calculates the values of »output« time-series, taking into account internal properties of all the input time-series simultaneously. In that regard, the prices of HS-HFO in Rotterdam, Singapore, Houston and Fujairah were considered as the »input« set; the algorithm produced forecasts for the future bunker prices in Rotterdam, Singapore, Houston and Fujairah based on all previous prices in these bunkering hubs. The analysis can include more »history«, e.g. the method can use the prices of the last week (week n) and of one week before the last (week n-1) and so on. In this publication it becomes clear that the consideration of more »history« improves the results (see Figure 1 that depicts forecasts for the Singapore market).

Figure 1 brings into question the measurement of the accuracy of the prediction. This is also an issue needs attention. When the root-mean-square error or root-mean-square deviation (RMSE or RMSD) is zero, then the forecast is perfect, yet in practical applications this is impossible. Therefore a method is better than another one, it is implied that the forecasted accuracy is improved, when the calculated RMSE is less than the RMSE of the other method. One should estimate and compare the RMSE of various methods and techniques for the same sample, in order to fairly compare the two approaches. The depicted results of Figure 1 support the belief that the method presented can give accurate results, and a better »input« mix could improve the accuracy; further research is therefore required. Finally the same team* is exploring other methodologies, such as the »fuzzy« ones, that seem to offer promising results (see Figure 2) without much of calculation effort, i.e. within few minutes instead of hours or days required for more sophisticated methods, such as the one presented previously. Coming into a conclusion it is fair to say that bunker prices cannot be predicted accurately, yet advanced techniques can provide a solid basis of arguments and values to be considered in future projects and hedging schemes. One could consult a prediction tool or method before fixing bunkers or key-in a bunker-price estimation in a worksheet. Finally, experts in other markets use these kinds of tools, such as in stock markets; none can predict the markets perfectly and if this was possible that would terminate any trading transactions, as both sellers and buyers would not have any trigger to trade, as the future price will be known. Focused research could however explain the evolution of prices, and assist operators and financiers in specific cases where high quality prognosis is required.

Orestis Schinas, Christos Stefanakos