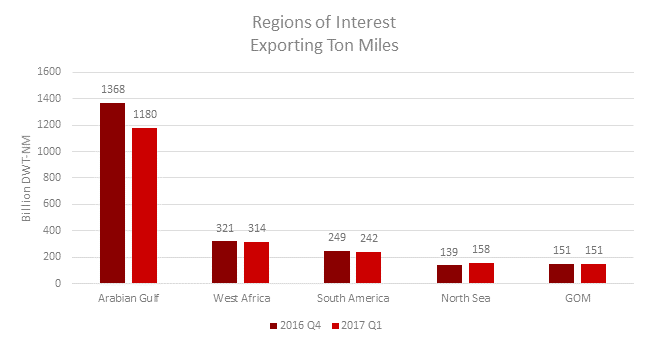

In the irst quarter of 2017 seaborne demand for Arabian Gulf crude exports went down 14% in VLCCs and Suezmaxes. Exporters of crude in the North Sea saw seaborne demand for VLCC and Suezmax cargoes jump up.

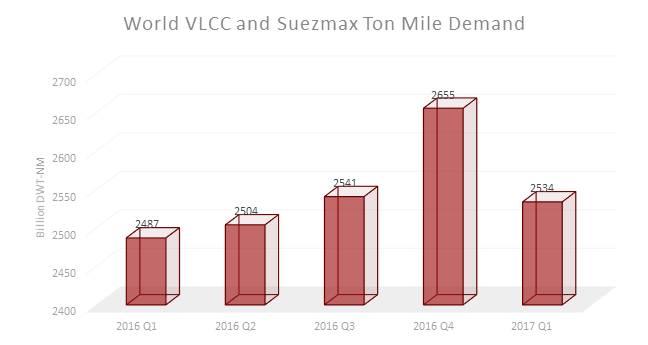

In Q1 2017, over 2.5 trillion ton miles were completed by the global VLCC[ds_preview] and Suezmax fleet. This was down 4.6% from the previous quarter with a reduction in VLCC work done being the major contributor at -5.42%.

According to William Benentt, Senior Analyst of market intelligence platform VesselsValue, over 50% of seaborne demand for crude exports stems from the Arabian Gulf. In Q1, AG export ton mile demand fell by a mammoth 14%. This follows promised OPEC production cuts, however, evidence shows that although AG exports are down, the slack is being met elsewhere.

Exporters of crude in the North Sea saw seaborne demand for VLCC and Suezmax cargoes jump 14% in Q1. It was the strongest quarter in history for North Sea exporters.

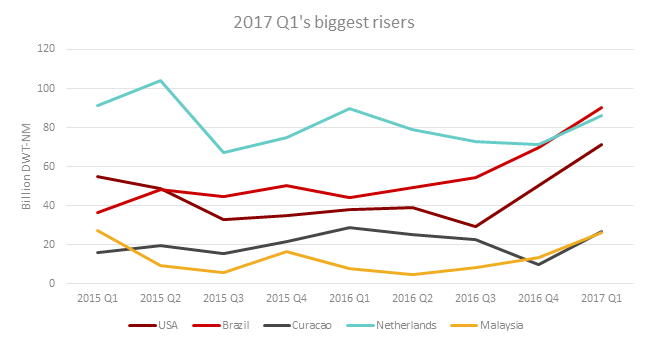

Also filling the gap is the United States of America, says Bennett. Ton mile demand rose above 70 million ton miles which over the last two quarters represents an increase of 145%. A number of these journeys are comprised of VLCC cargoes over Suezmax on the long-haul from US to locations such as China and Singapore.

The last quarter has shown that world VLCC and Suezmax ton miles have decreased; as have exports out of the Arabian gulf. However, smaller producers have worked to meet the gap in demand, the analyst says.