Signals are set on »go« for the effectiveness of the Ballast Water Management Convention ten years after launching. A latest update by Michael vom Baur

On 5 December 2013 the Assembly of the IMO, which is its governing body, has adopted a draft resolution of[ds_preview] MEPC 65 in London that considers the various concerns tabled by some important flag states and leading shipping organizations such as Bimco, Intertanko and Intercargo. With this step, welcomed by almost all shipping stakeholders, all signals seem to be set on »go« for making the IMO Ballast Water Management Convention (BWMC) effective soon.

The »International Convention for the Control and Management of Ship’s Ballast Water and Sediments« had been launched in 2004 and is ten years later (per 1 January 2014) ratified by 38 countries (threshold = 30), representing 30.38% of the world tonnage (threshold = 35%) – not yet enough for setting the convention in force. However, countries such as Panama (approximately 20% of world fleet tonnage), Hong Kong (7%), Singapore (5%), Bahamas (5%), Greece (4%), Malta (4%), China (4%), Cyprus (2%), UK (1.5%), Japan (1.5%) or Italy (1.5%) are expected to ratify now, after reasons for concerns have been removed.

In a nutshell, these concerns were: the need for revision of the IMO approval guidelines G8 to improve transparency and robustness under all operational conditions, the lack of clarity regarding port state control, and the fixed dates in the IMO implementation schedule, which have been considered as obsolete due to the slow ratification process.Core messages of the adopted MEPC 65

resolution are as follows: The first is that retrofits of ballast water treatment (BWT) systems shall be done during the first regular planned docking after the effective date of the convention, which will be twelve months after full ratification and could be in Q2 2015. However, it has to be mentioned that the US Coast Guard deadlines remain unchanged so far and so do the deadlines of the state of California, thus already putting US traffic under time pressure. The second is to grant a three year test period for the functional verification in the framework of port state control during which a malfunction should not trigger sanctions against the shipowner. This idea addresses the fact that the procedures and methods for effluent analysis are still under development and a major challenge. However, since the handling of such grace period will likely be left to the discretion of the individual port states there may be attempts to »sell compliance stamps« somewhere (similar as just experienced with the Maritime Labour Convention / MLC). And finally MEPC 65 intends to make the IMO type approval procedures more transparent and in particular more meaningful regarding the performance of the BWT system under all operational conditions (same as US Coast Guard has aimed for).

Market update: Light at the end of the tunnel for BWT makers but also capacity bottlenecks visible

The early movers among the developers and makers of BWT have suffered tough times until the IMO BWMC became a »teenager« and likely enters into force in 2015. Some have given up (Hamann/Sedna and Wilhelmsen/Unitor), others appeared as new players on the BWT market during the past months (e. g. BSky, MMC, Trojan Marinex, Bio-UV). In November 2013 Siemens Industry sold parts of its water technology branch including the SeaCure BWT technology to US investor AEA who runs the business through Evoqua Water Technologies based in Georgia/USA.

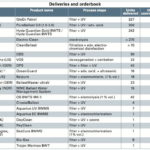

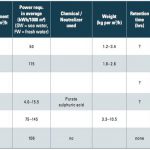

Most of the makers report significantly increasing project activities, in particular now also for the retrofit market with an estimated potential of nearly 70,000 ships. As the ship operators must install a BWT plant at the first renewal survey docking after the IMO BWMC becomes effective (this could already be around Q2 2015), the demand for retrofit plants is estimated at nearly 5,000 units per year in 2015–2016 and then to increase to over 12,000 units per year at least for the rest of the decade. The USCG estimates that approximately 9,000 foreign-flagged vessels are visiting US ports every year for which compliance with US ballast water regulations (and earlier than for the IMO regulations) will now become mandatory, even if the implementation schedule could be a bit protracted. Furthermore, also in the coming years up to around 3,000 newly built ships annually will have to be equipped with a BWT plant. Compared to this future demand scenario the actual figures look relatively small: By January 2014 approximately 1,370 BWT units have been delivered, more than 1,100 of which are commissioned, nearly all for newly built ships. Almost 2,000 more BWT systems are in the order books, according to maker feedback to HANSA prior to this article. Most of those orders are still designated for new ships under construction with deliveries stretching into 2016. All this demonstrates that the upcoming effectiveness of the IMO BWMC could lead to serious capacity bottlenecks on the supply side and thus may change the BWT arena from a buyer’s into a seller’s market soon. For the time being the competition among BWT makers is still fierce: Although not all of the makers have delivered input for the actual HANSA market survey, Tab. 1 (deliveries and orderbook) shows that some of them have achieved a strong market share: Approximately 90% of deliveries and orders have been acquired by only six out of more than 35 makers.

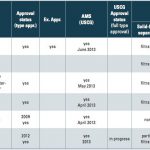

However, there is room for others, even for new entrants. In particular the retrofit demand surge and the expected bottleneck situation in supply capacity might create new champions, especially if they are able to provide leading edge and reliable treatment processes while taking into account the more obvious challenges and lessons learned in the meantime. On the other hand, many makers stated towards HANSA that they expect further companies to vanish during the next two years and also broader consolidation on the BWT market. This is a dimension which has to be carefully investigated by shipowners when selecting the BWT system. There is indeed a wide choice of makers: The number of treatment processes with IMO type approval is actually 33 and thereof 19 have already received the temporary (5y) USCG approval AMS (see maker overview Tab. 2). A full US approval has not yet been granted, but at least twelve makers have started the procedures that are more comprehensive than the IMO G8/G9 procedures. In June 2013 classification society Det Norske Veritas (DNV) achieved the status of an Independent Laboratory (IL) from USCG – the second after NSF International –, so more labs will be joining the list soon. This will contribute to accelerating the market development. Shipowners who are be able to finalize their »planning homework« shortly may still have the opportunity to secure timely BWT plant delivery slots for relatively low prices with the »hungry« makers.

How to select the best suitable BWT system?

All BWT processes offered have their strong and weaker points, which may be of different importance depending on trade pattern, ship type and size. It is obvious that a decent technical, operational and economic analysis, including a diligent assessment of the future availability of the maker as well as the compliance perspective with the strict US rules, is a must before any investment decision would be drawn, in order to avoid surprises and insufficient performance.

The starting points of such analysis must be size and characteristics of ship and trade(s) to be covered. The following issues should be analyzed carefully:

- BW capacity of the vessel, typical volumes for one load or discharge operation, pumping rates;

- trade pattern: time between ballast operations, location of ballast operations, BW characteristics at uptake points (range of salinity, temperature, organisms, sediments etc.)?

- time constraints for BW operations and BW treatment?

- Characteristics of the ship’s planned or existing BW system:

- centralized BW system or independent units?

- Hydraulic analysis of the BW system:

- BW pump sizes and reserve capacity, design pressures vs. pressure drop of the BWT system (e. g. larger BW pumps necessary due to BWT system?);

- tank sounding and valve/pump control system;

- tank corrosion protection system;

- space/weight constraints on board? Compare weight/footprint of BWT systems;

- Check electrical load balance and auxiliary/generator capacity and systems (incl. automation, controls and alarms): What are the implications of the BWT system?

- ship’s need for explosion proof equipment (tankers, gas carriers, gas fuel)?

- requirements of BWT system vs. ability to handle chemicals and understand complex analytics/controls on board (crew qualification, HSE)?

- other relevant requirements or constraints of the service?

- Based on these considerations the BWT options, which are most appropriate for the case, can be short-listed. When comparing and benchmarking the different process (maker) options, the optimum will be found in the triangle marked by the corners

- low investment, minimum installation and operation cost,

- simplicity of operation, minimal necessity for human interference, and

- reliable performance: proof of fulfilling IMO D2 and (if necessary) USCG standards in all possible BW intake locations of the trade pattern.

HANSA has asked BWT makers for their update information. Tab. 2 provides an actual maker overview based on the received and public accessible information.

When assessing the investment (in particular for retrofit projects), any cost for necessary modifications in the ship’s energy supply or BW system (pumps, pipes, valves, controls) must be carefully evaluated and considered as well, in addition to the cost for the BWT plant itself. For assessing liability and performance, maker-independent contacts with reference operators for a unbiased feedback on their experiences would be advisable.

Technology basics and challenges

Ballast water treatment is in principle facilitated by two types of process steps: a physical solid-liquid separation, which should already remove most larger organisms, and a disinfection step, using chemical reactions or physical effects, such as UV radiation, pressure pulses (cavitation), ultrasonic treatment or (inert) gas injection. Most offered systems feature both process steps, some even combinations of different disinfection means for enhancement. Details of the process steps have been described in HANSA 09/2011 and 10/2013. With the increasing number of BWT plants in daily operation, challenges become more and more evident. BWT expert Stephan Gollasch (GoConsult, Hamburg), who has been involved in the IMO development from the beginning, says that most processes work satisfactory. He also hasn’t seen any new BWT technology or process appearing on the market during the last year, which he would consider as more promising compared to the previously known processes. However, according to his observation, not all systems may meet the standards (IMO or USCG) under extreme environmental and biological conditions. Unfortunately, the USCG issues relating to the UV system performance and acceptance had caused some confusion, but they are on the way to be resolved. The variety of water conditions, the different quantity and kind of organisms in different regions, in particular the different filtration characteristics (»softness«) of species in fresh and sea water, and the heavy sediment load in many coastal waters create headaches for many BWT makers’ filter steps. Manufacturers have different strategies to cope with filter challenges. Some examples: While Mahle successfully relies on a two-stage filtration, Trojan Marinex has invested in a custom-designed new filter technology and BSky picked up the powerful, but energy-consuming hydrocyclone technology again. Many large ports (e. g. Shanghai, Rotterdam, Bremerhaven etc.) are located in river estuaries. The high content of solids taken up in these locations is not the only filter challenge. In these mainly low-salinity waters live also different organisms which have a »softer« body and tend to pass fine mesh filters of 40–50 even when they are larger than 100 . These species are an unexpected challenge also for the following chemical or physical treatment steps. Electrolysis systems need extra salinity infusions to work and may become very energy consuming in fresh and brackish waters. However, a side stream solution with about 1% of the ballast water flow, as used in Evoqua’s (ex Siemens) SeaCure system, allows using stored aboard high-salinity seawater to feed the electrolyzer when the vessel is in brackish or fresh water and thus keeping required energy and its cost for chlorine generation to a minimum. It can also contribute to the safe removal of hydrogen gas by-products and preventing its desorption and accumulation in the ballast tanks. This matter has also been addressed by RWO Veolia, who have been selected by Seaspan for their 10.000 TEU container vessel series and successfully completed a hydrogen risk assessment process with Det Norske Veritas in 2013.

During 2013 the Electro-Cleen BWT system of the Korean maker Techcross, of which 210 units are commissioned, suffered incidents on two vessels, where overpressure of water vapor and gases caused by continuous supply of power broke the main electro chamber unit. According to the maker this happened in manual mode, where alarms and shutdown procedure could be overridden by a mistake, which has been removed meanwhile.

UV systems suffer from the lower UV transmittance in freshwater as well from the usually higher turbidity in coastal waters. Makers react with refined automation processes for the UV operation, for example DESMI, whose new RayClean process features fully automatic adjustment of the UV treatment according to water quality by e.g. flow volume and speed, which has been successfully demonstrated in the port of Lisbon recently.

In HANSA 10/2013 we had noted that the performance of hypochlorite generation is reduced at water temperatures between 10 to 15 °C and that most electrolytic technologies are facing challenges during winter in Northern Europe, Canada, Russia and Alaska at water temperatures below 5 °C. One way of overcoming this issue (for side stream solutions such as SeaCure) could be feeding a side stream using warmer seawater from the cooling line.

The more descriptive USCG approval tests, which cover a broader range of water condition scenarios, will contribute to make process technology-dependent deficiencies in BWT performance more visible for ship operators. The USCG approval criteria may even form a too high threshold for some processes. However, since there is hardly any USCG approval experience at this time (except the intermediate AMS), it is hard to predict which technologies may be »endangered«. Most makers are perfectly aware of the challenge and develop appropriate solutions to close eventual performance gaps. Regarding the final verification of a proper BWT system function in port state control procedures there is not much development compared to our report in HANSA 10/2013. The respective IMO MEPC subcommittee is still working towards draft procedures, which have not yet been unveiled.

Author: Michael vom Baur, Naval Architect

MvB euroconsult, Admannshagen/Germany

michael.vombaur@mvb-euroconsult.eu

Michael vom Baur