The cruise industry breaks new records and remains the bright spot of the shipping markets, which are

still characterized by big slumps and consequences

of crises. An overview of operators, fleets, shipyards and new markets

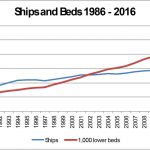

By mid 2015 the ISL Ocean Cruise Fleet (ships >100 lower beds) comprised 292 vessels with 473,000 beds, the largest[ds_preview] capacity ever for pleasure cruises. The average capacity rose to 1,619 passengers per vessel and the total tonnage to 18.65mill. gt, resulting in an average size of 64,000 gt per ship. Following years of slow growth more new ships will be delivered in 2016 and three marks will be achieved soon: 300 ships, 500,000 beds, 20mill. gt.

Operators

While one year ago MSC Cruises was highlighted in this report, we turn our attention to the east this time. In late summer 2015, the Malaysian Genting Group was exploring the chances to build spectacular new cruise vessels in the Lloyd Shipyard of Bremerhaven. This very old repair shop of the ancient Norddeutscher Lloyd acquired world-wide reputation by converting the liner »France« into the cruiser »Norway«, by implanting a new heart into the »QE 2«, and by lengthening several series of early modern Caribbean cruise vessels. Later on they fitted out a few hulls for Costa Cruises and NCL, but never built a vessel from the scratch.

The Genting Group has acquired the California-based Crystal cruises from the Japanese NYK group and is keen to realize the long-planned extension of the high-class two-ship fleet. Because of the full order books of the established cruise shipyards they approached Lloyd Werft. By outsourcing the steel works and focusing on fitting out in Bremerhaven they will be able to deliver the first newbuilding in 2018, providing some investment into the yard is done. The probably cash-rich casino and leisure group Genting solved the way of financing the deal in its own way: They bought a stake in the shipyard and in early 2016 they became 100% owners of Lloyd Werft. Meanwhile, the whole deal includes four contracts for river cruise vessels to be delivered in 2017 and three contracts for ice-strengthened ocean cruise vessels with 100,000 gt for 1,000 passengers and 1,000 crew, to be delivered in 2018, 2019 and 2020 respectively.

Moreover, Crystal Cruises started yacht cruising by converting one small vessel of the group and ordered aircraft for air cruise travels. The Genting Group comprises Star Cruises with several ships in Southeast Asia and China and has two 150,000 gt ships on order at Meyer Werft. These will be marketed under the new brand Dream Cruises.

On a lower level, but surprising too, is the announcement of Scenic Tours to enter ocean cruising. This Australian tour operator has built up, and continues to do so, a fleet of 135m river cruise vessels in Europe under the brands Scenic Tours and Emerald Waterways. In January 2016, Scenic published the design of a discovery yacht of 165m length for only 228 passengers and 172 crew. With highest comfort and safety features – built according to Polar Code standards – they aim to top the expedition cruise fleet. The first one is to leave the Croatian Uljanik Yard already in 2018, an option one year later.

The Big Three

The Carnival Group is reporting the best ever third quarter of a business year, better results than expected for the whole year and better bookings than the year before. Several previous announcements regarding the fleet modernization are more precise now: The next batch of ships from the »house shipyard« Fincantieri consists of two 4,200 bed ships for Costa Asia, the same size as for Carnival Cruise Line. It also comprises a further unit for Princess Cruises with 143,700 gt, the largest to be built up to date. A further 135,000 gt/4,200 lower bed unit will be delivered to P&O Australia, the first newbuilding ever for Australia. The four ships will be delivered in 2019 and 2020. Before the first new ship comes to Australia, Holland America Cruises is now shifting the 55,919 gt vessels »Statendam« and »Ryndam« to the sister brand as »Pacific Aria« and »Pacific Eden«.

Meanwhile, Carnival brand AIDA has returned to the Meyer Group. Meyer Werft had built seven 2,000 bed sisters for AIDA Cruises before AIDA turned to Mitsubishi for two larger ships. However, the »AIDAprima« is much delayed and the two sisters will probably be delivered in 2016. Because of the bad experience and big losses Mitsubishi ceases constructing cruise vessels and AIDA went back to Meyer for the next class. These two AIDA ships are ordered for 2019 and 2020 with the Papenburg shipyard while Costa Cruises will get two similar units from Meyer’s Turku shipyard in 2020 and 2021. All four open a new dimension in the Carnival Group: 180,000 gt and 5,000 lower beds. These vessels increase the Carnival order book between 2016 and 2021 to 17 orders – two to three per year. As usual – but this is not all. The joint venture between Carnival, Fincantieri and the Chinese shipbuilding group CSSC has announced the first of, probably, five contracts to be placed at the Shanghai Waigaoqiao shipyard. The ship to be delivered by 2020 to the Chinese market will be larger than 100,000 gt. The contract earlier signed with Xiamen shipyard was cancelled. Thus, Carnival increases presence in China which will further be firmed by an AIDA vessel in 2017.

Royal Caribbean Group will also build up its presence in China but goes ahead faster. The first of a new ship class, the »Quantum of the Seas«, was sent to China after only one season in the Caribbean Sea. »Ovation of the Seas«, the third of the class (168,666 gt, 4,180 beds), will be adapted to the Chinese market before direct delivery to the Far East. The big success of this new class leads to the orders for a fourth and fifth unit at Meyer Papenburg. Besides the Quantum-class two ships of the Oasis-class – still the world’s largest with 227,000 gt and 5,400 beds – are under construction in France. The two letters of intent from STX France for the Celebrity brand are not yet reported as confirmed. Regarding the aim to increase profits, RCL is very successful, assisted by low oil prices and strong markets in China and the Caribbean. Only the performance of Pullmantur in South America is not satisfying.

The order book of Norwegian Cruise Lines – three times 4,200 passengers – stretches »only« into 2019. News of this group are more deployments in Germany and a first entrance into the Chinese market. The »Norwegian Star« (2001) will be based at the East German port of Rostock-Warnemünde in summer 2016, the »Norwegian Jade« (2006) will make 19 trips from Hamburg in 2017 and the brand new »Norwegian Bliss« will start her career in China in 2017. For the German speaking markets NCL will introduce »premium all inclusive« prices.

MSC Cruises was expecting four new ships in 2017, 2018, and 2019 and held three options. Early in February two of the options at STX France were not only confirmed but also the number of cabins increased by 200 to 4,888 (maximum 6,300). And the completion was brought forward to late 2019 and 2020. With the bigger fleet the regions of employment can be extended. The new Seaside-class is designed for the Caribbean Sea while stretched vessels of the first generation are foreseen for new regions: a second one will be used for Cuba cruises and another one was specially modified for China, e.g. with sun protection over the sun deck.

Amongst the most successful operators is the German TUI Group. The traditional Hapag-Lloyd brand comprising »Europa«, »Europa 2«, and two expedition ships is earning good money again and plans to replace the chartered »Hanseatic«. The TUI/RCL joint-venture TUI Cruises is expanding every year. Having introduced »Mein Schiff 4« in summer 2015, the numbers 5 to 8 will follow in yearly intervals until 2019. When »Mein Schiff 7« and »8« are delivered »Mein Schiff 1« and »2« will be transferred to the British TUI brand Thomson to replace two older ships chartered from the Louis Group there. Moreover, the »Splendour of the Seas« was sold from RCL to TUI Cruises to be renamed »Thomson Discovery«.

Finally some news from smaller operators which will hardly find suitable second-hand tonnage with less than 1,000 beds. Viking Ocean Cruises, sister company of fast expanding Viking River Cruises, announced to order more 928-bed ocean cruise ships than are currently under construction at Fincantieri. The series could grow up to six vessels. The »Viking Star« was introduced as lead ship in 2015. The adult-only operator Saga Cruises of Great Britain has ordered a 1,000 bed vessel from Meyer Papenburg with an option for a second one. The German dream ship »Deutschland« returns to Germany during the next summer seasons. It will make two »Semester at Sea« trips per year for its new US owner, but for five summers it will be offered on the German market under charter to Phoenix Reisen of Germany, augmenting their three ship fleet.

China

The Chinese market once more requires our attention. The China Cruise and Yacht Industry Association reports 697,000 cruises sold in China in 2014 and expected 1mill. in 2015. Other sources report an increase of 5% in the first half of 2015. Anyway, the tonnage planned for China will lead to major increases of capacity and, probably, also of demand. The forecast of the association is 2.5mill. by 2020 and 7mill. by 2030. The government is fostering the development by allowing foreign companies to enter the market, investing in cruise terminals and asking the employers to grant more holidays to the employees. The state-owned shipyards want to construct cruise vessels.

The Chinese have to learn that a cruise ship is a place for holidays and not only a means of transport. Nearly 96% of cruises take place in Asiatic waters close to China. Cruises usually shorter than seven days make it easy to achieve a high number of cruises. It would be better to compare the cruise nights with other markets. The ship operators seem to have learnt their lessons. In the past they brought their American style or European style vessels more or less unchanged into the Chinese market. But there the travel culture is different. The Chinese prefer other kinds of food, shopping, gaming and avoid the direct sun impact. So it’s better to provide modified ships or even better new ones which get fitted with casinos, luxury boutiques, and sun protection on the open decks already during the building time and boast many of the modern features too. The not yet completed »Ovation of the Seas« or the »Majestic Princess« to be delivered in 2017 are examples of such adapted vessels. So it is not sure if more smaller and elderly ships will be bought by Chinese owners like HNA, Bohai Ferry or Ctrip.

A setback occurred in summer 2015 when the Middle East Respiratory Syndrome (MERS) claimed nine lives in Korea. Following years of continued growth in Chinese tourist arrivals and spending MERS health crisis devastated the travel industry. According to recently released figures from the Korea Tourism Organization, the crisis – which was officially declared over in late July – dissuaded tens of thousands of tourists (most of whom would have been from mainland China and en route to Korea primarily for shopping). This lead also to re-routings of cruise ships, a problem also known in other regions were, admittedly, more choice is available.

Shipyards

The leadings cruise ship builders still are Meyer and Fincantieri. Fincantieri relies on several plants in Italy for both larger and smaller ships, while Meyer has grown by acquisition of the experienced Finnish yard in Turku sold by the STX Group and formerly owned by Aker and Kvaerner. Following a participation of 70% Meyer is now the sole owner of the Turku plant. The order book is filled until 2021 with four ships for TUI Cruises and two giants for Costa Asia besides a cruise ferry. The main plant of the Meyer Group in Papenburg had concentrated the construction work in the larger of two covered docks because of the increasing ship sizes but will reopen the smaller dock for the Saga Cruise contracts of »only« 56,000 gt. Altogether the order book of Papenburg comprises eleven ships. Both yards are assisted by the Meyer-owned Neptun Werft in Rostock-Warnemünde which builds river cruise vessels and blocks for Papenburg and Turku.

No. 3 in the world league is the still Korean-owned STX France of St. Nazaire. They are building the two Oasis-class giants, four ships for MSC and have letters of intent for the Celebrity ships of RCL. These are the established builders of large vessels. Mitsubishi is leaving the scene again after delivery of the two AIDA ships, and with Waigaoqiao the first Chinese yard will enter the big ship cruise market by 2020. Before the Chinese can demonstrate their products, other European contenders will show their performance, Lloyd Werft with several contracts for Crystal Cruises and Uljanik with discovery yachts. The number of members of this club is still small because it is not easy to enter it.

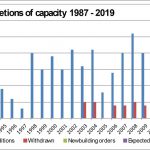

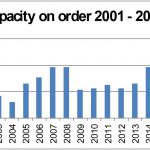

The order book is now the highest ever, summing up more than 150,000 lower beds, the options and letters of intent not included. It stood above 80,000 beds just before the terror attacks of New York and close to 100,000 before the world financial and economic crises. By mid 2015 it reached 120,000 and surpassed the 150,000 beds barrier in early 2016. A further increase is possible, however, the deliveries will also increase this year. The graph »Capacity on order« shows that the ship operators react very carefully if demand lessens like in 2001 and 2008. They wait for years to be sure that demand has really recovered before ordering new tonnage.

For the usual demand growth the addition of 20,000 new beds per year has been sufficient. The current order book stretches over more than five years resulting in about 30,000 beds per year. This is under the assumption that the 2016 and 2017 deliveries are known and not much will be added to the 2018 deliveries. In fact, more than 30,000 will be added in 2016, but less in the two following years. That means an even higher growth in 2019/20. The traditional markets America and Europe will hardly absorb so many new beds but the Chinese market is expected to do so.

Arnulf Hader