The shipping industry in the Great Lakes region is facing tough challenges. A recent action plan aims to create a robust and unified Maritime Transportation System, albeit at the hefty cost of 3.8 bn $ over a decade

Around the Great Lakes, a vital economic engine for both the United States and Canada, stakeholders are re-grouping – bringing[ds_preview] together the eight states and two provinces participating directly in maritime activity and feeding a vast hinterland. A June 2016 paper commissioned by the Conference of Great Lakes and St. Lawrence Governors and Premiers (CGLSLGP), an organization with U.S. roots from the early 1980s (with the Canadian premiers joining in 2015) presented a ten-year action plan for creating a robust and unified Maritime Transportation System. Over a decade, costs of 3.8 bn $ are budgeted. Background put together by economists at BMO Capital puts the size of the region’s economic output at 5.8tr $ – which, it said: »…would rank as the third largest economy in the world if it were a country.« Citing another organization, the Chamber of Marine Commerce (made up of Canadian and U.S. carriers and cargo businesses): »…shipping in the region supports 227,000 jobs, and produces 35 bn $ of business revenue…«

The region’s maritime aspirations face challenges, which – as the cliché goes – present opportunities. The CGLSLGP’s ten-year regional maritime strategy, actually three years in the making, offers to »…rejuvenate the regional maritime system …« At numerous instances in the plan, stakeholders are implored to become aligned, to harmonize rules and present a united front. But the tactical recommendations also highlight contradictions facing the region, which is deeply intertwined with raw material supply chains for steel making, and – with knock on effects – the automotive and other steel consuming industries. The steel mills of the mature industrial »Rust Belt« landscape are critical to the U.S. economy, and this criticality informs on the strategy going forward.

Two key tactical points in the ten-year strategy, both aimed at keeping the flow of these raw materials, are construction of a second »Poe Class« Lock in Sault Ste. Marie, Michigan, which would allow the biggest »Lakers« (which can take 70,000t of ore) to transit, and dredging the system’s critical chokepoint – the St. Mary’s River (the site of the Soo Locks).

Regional and intra-governmental fragmentation continue to bedeviled Great Lakes shipping. Indeed, the remaining CGLSLGP recommendations concern legislation and policies, including »…recommendations for a treaty or other binding agreement between the U.S. and Canada to cooperatively manage the regional maritime system, and harmonize regulations across levels of governments.« Another group, the American Great Lakes Port Association, endorsed pending legislation in Washington, D.C. which mandates a harmonized language on »incidental« discharges from vessels- where all States would follow the Federal wording.

So, what is the future?

Its prospects will likely ebb and flow with economic currents; recent favorable job reports show a strengthening U.S. economy. The U.S. steel industry is also set to benefit from the imposition of new tariffs on imported steel imposed during early 2016. As noted in HANSA 08/2016, the political mood seems to have turned towards more, rather than less, protectionism generally; this trend is favorable for domestic U.S. steel producers. But the same article also noted an increased consciousness from both sides of the political divide about revitalizing declining infrastructure; such spending (including dredging) would help the Lakes region. A 2013 study by the U.S. Maritime Administration (MARAD) cited the cost effectiveness of Lakers compared to large railroad trains, for moving iron ore (on U.S. flag vessels), with a forecast that ton-miles of iron ore could increase by 1% annually.

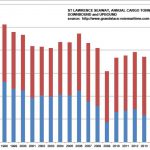

On a less favorable note, the trend away from steam coal (for power generation) would be negative for marine transportation in the region; much of the coal moving on the Lakes (some 24.5mill. t in total in 2014) is »steam coal« moving from by rail from inland mines and then shipped to power generation plants aboard a Laker). Increasing environmental regulations have led to closures of power plants, and lower prices for natural gas (an alternative for power generation) have driven a shift away from coal – with some 42.8mill. t moving as recently as 2005.

But even with more steel-related raw material movements, the bigger conversation is about conserving and optimizing existing flows; thereby creating and exploiting incremental advantages, not about carving out big swaths of new business. Nevertheless, new trades have emerged in recent years. Dave Walker, Vice President at CanAm Ship Management (based in Thunder Bay, on Lake Superior), talked to HANSA about another aspect of the Soo Locks: »It’s not only the American and Canadian dry bulk trade that benefits from this critical Sault Ste. Marie facility; the economics also work well for the project cargo trade. Thunder Bay and sister-port Duluth, Minnesota, both offset these project voyages by providing return grain cargo. In addition to the ocean-going bulkers ballasting into the region from their Great Lakes discharge ports, this directly benefits the heavy-lift operators«, referring to movements of wind energy equipment.

Because intra-Lakes trade does continue during the winter, Ice breaking capacity is a sore point; many of the trade associations are pushing for U.S. Coast Guard funding of a new ice-breaker. After more than a decade of discussion, there continues to be hope for »short sea shipping« – striving to divert cargo away from congested roadways (or railways, notably around the industrial complexes south of Chicago and Detroit). The mission of »Highway H2O«, a bi-national logistics group composed of ports, shipowners and cargo interests, is just that, creating real business that will move on the marine highway rather than on surface transport alternatives. Highway H2O is more than a cheerleader; incentives for new customers include discounts on Seaway tolls. Mr. Walker, from CanAm Ship Management, provides a real example of new trades emerging: »Our Lake Superior location gives ideal positioning for project cargo requiring the furthest inland ports, a major benefit for both the renewable and fossil energy industries.«

Berry Parker