The global number of newbuilding contracts collapsed dramatically in 2016. Shipyards are struggling to attract new orders. The demand for[ds_preview] most types of cargo vessels is extremely low but some niche markets still showing healthy orderbooks

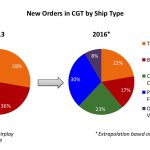

The maritime industry comprises a variety of diverse market segments. While interdependencies between these market segments are limited, the unusual parallel downward trend across several segments, especially cargo markets but also the energy sector, continued in 2016. The declining demand for tankers, bulkers as well as container vessels is extreme. In the period from January to November 2016 the number of new orders for cargo ships shrunk by more than 80% compared to 2015. The acute weakness of these mass markets is equally felt in the respective, mainly Asian shipyards as well as the entire, worldwide supply chain.

This is aggravated by the fact that the offshore-market is at a standstill and with the oil price remaining low an imminent recovery is not expected. The offshore oil & gas production will revive at some point and will remain a major maritime market for the foreseeable future. The same goes for the deconstruction of aging, obsolete or inactive offshore assets. IHS Markit expects an additional 2,000 offshore projects to be decommissioned between 2021 and 2040 with expenditures of 210 bn $ between 2010 and 2040.

The current low oil price also provides little incentive to replace vessels of the existing fleets with more energy-efficient ships. At the same time stricter international environmental and climate protection regulations might stimulate future shipbuilding activities as the required, extensive retrofits and conversions may not always appear feasible for older vessels. Hence an early investment to meet these new requirements can be economically advantageous, especially if the oil price should rise again accelerating the return on investment e.g. in alternate fuels and other innovative technologies.

The main concern for today’s shipping world however relates to the weakness of global trade. The global economy appears to be undergoing structural change: Since 2012 world trade, usually growing twice as fast as GDP, has been growing at almost the same rate as the world economy. According to IMF a world trade growth of 2.3% is estimated for 2016, which is even lower than the expected global GDP growth of 3.1%. Protectionist tendencies, low commodity prices and various political tensions and conflicts play a decisive part. Furthermore, certain economic and technological developments are likewise slowing down the globalization process. The cost benefits of shifting production to low-wage countries appear to be dwindling. What is more, innovative production methods encourage re-shoring of production capacities, resulting in shorter transport routes. In addition, containerization appears to be reaching a point of saturation and the ability to achieve efficiency improvements by deploying larger ships seems to have arrived at a limit, as well. Weak trade growth translates to weak marine transport growth, exactly the opposite of what is needed to digest the tonnage surplus that resulted from excessive ordering during the past years.

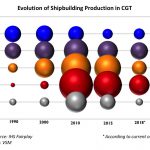

According to some stakeholders the shipping markets are facing the worst crisis in over a century in terms of overcapacities and low freight and charter rates. The expansion of the global shipbuilding sector seen since the early 2000s is most definitely over. Today, the protagonists have to cope with its aftermath. With less than 8.7mill. CGT during the first three quarters of 2016, new orders dropped to the level of the 1980s.

The resulting pressure on shipyards is extreme. According to Clarkson Research the global number of active shipyards has more than halved since the beginning of 2009. Especially Asian yards, which mainly focus on cargo vessels, are struggling with the low demand for those ship types. By November 2016 Asian yards had acquired no more than 327 newbuild contracts, worth about 12.9 bn $, which corresponds to approximately 17% of previous year’s value. With shipyards striving to attract new orders newbuilding prices have fallen further. Public support, particularly in some Asian countries, including tough local content requirements and stimulus programs to create »artificial« demand from domestic entities, are distorting competition and hampering a quick recovery of these markets. According to IHS Fairplay roughly 90% of orders from Asian shipowners are placed at domestic shipyards. As for Germany, these statistics are reversed: the share of domestic ordering of commercial seagoing vessels has been a low single-digit percentage on average over the past decade.

However, in times of extremely low new order figures in all volume markets, the success of the passenger ship segment is remarkable. Within the last three years new orders for passenger ships more than tripled, reaching 3.4 mill. CGT from January to November 2016. European shipyards benefited from increasing investments in passenger ships, especially cruise vessels, logging newbuild contracts worth 17.3bn $ in the period from January to November 2016, which corresponds to a global market share of 56%.

German shipyards have turned away from standard ship types to focus on passenger ships, ferries, yachts, and other special-purpose vessels instead, and are assuming leadership in green technology and advanced solutions for demanding customers. Against the global trend, German shipyards were able to achieve sound order intake, retaining a global market share of 18% in terms of value. Export-oriented German suppliers are expanding their expertise in research, development and innovation while weathering the current low demand. As a result German maritime suppliers can offer customized solutions for retrofits and green technology and contribute to fleet efficiency, safety, and environmental sustainability. Shipowners globally are experiencing difficulties accessing financial markets as ship financiers continue to struggle with bad shipping loans in the wake of the 2008 financial crisis. To counteract this difficulty, members of the German maritime industry have establish GeMaX – a platform offering sourcing and financing support to international shipowners and maritime contractors. www.german-maritime-export.de

VSM