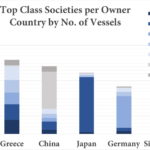

The classification market is global and competitors do not care about national borders. However, as these data show, there is[ds_preview] still some kind of cohesion in the fleet.

In the figure on the left, it becomes visible that there is a very big correlation between the home countries of shipowners and the classification society they choose for a huge part of their fleet. This is the case especially for Japan, China and Germany, where a huge share is taken by ClassNK, China Classification Society (CCS) and DNV GL, respectively. In this figure, we included China Classification Society (CCS), because of Chinas shipowners being in the top and they appear to class most of their vessels with CCS.

However, especially in the last years, which were characterized by the huge shipping crisis, a lot of societies intensified their efforts to attract new clients abroad. One example is the big campaign, ClassNK launched for Germany since at least 2014.

Further, taking a look at the values of the classed fleets, one can see it is not necessary to have the biggest fleet in terms of numbers to pool the one with the highest value. For ABS, obviously, the classification of Mobile Offshore Drilling Units, for which the U.S. Gulf is an important area, has a big impact. Its fleet is the one with the highest value, although the number of vessels from owners of the most important shipping countries (see the upper figure) is not the highest.