The reefer ship segment has been quiet in recent history, but there are several developments afoot that could change this. The fleet is aging, returns are nudging upwards, and shipyards remain hungry for work

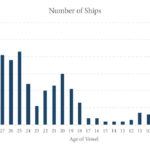

The average age of the global reefer ship fleet has risen to almost 30 years old, the traditional scrapping age[ds_preview] for these specialised vessels. Interest in newbuild orders for ships of this type has been depressed for the past fifteen years as the number of ships remaining in service was sufficient to meet the demand when combined with the increased reefer capacity in the global containership fleet.

Russia maintains a large count of ships, although the average age is very high, and the average size of 233,000 cubic feet, below the fleetwide mean of 267,000 cubic feet. Japan, by contrast, has a smaller but more valuable fleet that is half the age of the Russian one. The average vessel size is 321,000 cubic feet, which is bigger than average. Germany and the Netherlands both specialise in large ships, at 530,000 cubic feet and 404,000 cubic feet respectively.

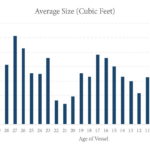

One interesting trend in the reefer ship space is that the average size of the units has declined over the years. This runs contrary to most shipping market segments, where larger sizes generally mean more efficient transportation and lower of cost.

The average earnings per cubic foot has trended flat from 2004 to the present, averaging 0.76$ per cubic foot. The market in late 2017 and so far in 2018 has been above this mean, which could contribute to interest in niche orders in the reefer segment.