Strong demand is still to come, so is potential for a wide array of producers. Latest market and technology update

The IMO Ballast Water Convention: Some obstacles removed by IMO MEPC 65

The »International Convention for the Control[ds_preview] and Management of Ship’s Ballast Water and Sediments« (BW Convention) had been adopted in 2004 and was per 31 July 2013 ratified by 37 countries (threshold = 30) representing 30.32 % of the world tonnage (threshold = 35 %), not enough for setting the convention in force. Countries such as Panama, China, Greece, Cyprus, UK, Japan, Malta, India, Italy, Finland, Estonia, Australia, Argentina, Chile, Peru, Singapore, and Indonesia are still hesitating and some had, jointly with leading shipping organisations such as Bimco, Intertanko and Intercargo, raised a number of objections. In a nutshell, these concerns were: need for revision of the IMO approval guidelines G8 to improve transparency and robustness under all operational conditions, lack of clarity regarding port state control, and the fixed dates in the IMO implementation schedule, which have been considered as obsolete due to the slow ratification process.

In its meeting in May 2013 the Marine Environment Protection Committee (MEPC 65) of the IMO has now addressed these concerns and proposed a draft resolution, which could remove most obstacles regarding the implementation of the BW Convention, if adopted by the IMO General Assembly in November 2013. The MEPC 65 draft contains three new aspects: The first is that retrofits of BWT systems are no longer stipulated to match a certain date but shall be done during the first regular planned docking after the effective date of the convention, which will be twelve months after full ratification. Thus, costly extra or »forced« dockings can be avoided and the BWT retrofit could be better integrated with normal maintenance or conversion plan. However, it has to be mentioned that the US Coast Guard (USCG) deadlines remain unchanged so far, so do the deadlines of the State of California, putting US traffic a bit more under time pressure.

The second new aspect is the idea to grant a three year test period for the functional verification in the framework of port state control, during which a malfunction should not trigger sanctions against the shipowner. This idea addresses the fact that the procedures and methods for effluent analysis are still under development and a major challenge. However, since the handling of such grace period will likely be left to the discretion of the individual port states, there may be attempts to »sell compliance stamps« somewhere – similar as just experienced with the Maritime Labour Convention (MLC).

Finally, MEPC 65 intends to make the IMO type approval procedures more transparent and in particular more meaningful regarding the performance of the BWT system under all operational conditions (same as USCG has aimed for). It is widely expected that the IMO General Assembly will adopt the MEPC 65 draft, although the vote in MEPC 65 was almost a draw.

This could motivate at least some of the missing and so far criticizing flag states with significant percentage of world fleet (as e.g. Panama ~20 %, Hong Kong ~7 %, Singapore ~5 %, Bahamas ~5 %, Greece ~4 %, Malta ~4 %, China ~ 4 %, Cyprus ~2 %, UK ~1.5 %, Japan ~1.5 %, Italy ~1.5 %) to ratify the BW Convention, as 37 states including Germany have done already, before the end of the year 2013. Even one of the top seven in the above list could close the gap to the last open ratification threshold from actually 30.32 to 35 % of the world tonnage and thus start the clock for the effective date of the BW Convention.

Disappointing market development so far, but surge of retrofit demand visible now

By the end of July 2013 approximately 450 ballast water treatment (BWT) units have been installed, while another 850 have been delivered and wait for commissioning, nearly all for newly built ships. At least 1,240 more BWT systems are in the order books, according to maker feedback to HANSA prior to this article, which is much less than makers were initially hoping for. Most of those orders are still designated for new ships under construction with deliveries stretching into 2016, while the retrofit market with an estimated potential of nearly 70,000 ships has not really developed yet.

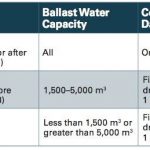

However, the number of retrofit projects is expected to surge in 2015, if the convention would indeed be fully ratified early in 2014 and thus entering into force at the beginning of 2015. Ship operators would have to comply with the IMO D2 standard and thus install a BWT plant at the first renewal survey after entering into force, and so the demand for retrofit plants is estimated with nearly 5,000 units per year in 2015–2016 and then to increase to more than 12,000 per year for at least the rest of the decade.

The US Coast Guard estimates that approximately 9,000 foreign-flagged vessels are visiting US ports every year for which compliance with US ballast regulations will become now (and earlier than for the IMO regulations) mandatory, even if the implementation schedule has been a bit protracted. All this could lead to serious capacity bottlenecks on the supply side, taking into account that also 2,500–3,000 newbuildings will have to be equipped with a BWT plant every year. Shipowners, who could finalize their planning homework shortly, still have the opportunity to secure timely BWT plant delivery slots for relatively low prices with the suffering and hungry makers. The competition among the makers is fierce, even if two of them have withdrawn their products during the past months (Hamann/SEDNA and Wilhelmsen/Unitor).

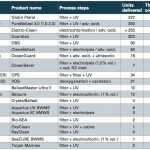

Meanwhile, the number of BW treatment processes with IMO type approval has increased to 33. Thereof eleven have already received the temporary (5-year) USCG approval AMS (see maker overview Tab. 3). A full US approval has not yet been granted, but at least four makers have started the procedures, which are more comprehensive than IMO G8 / G9 procedures. Since June 2013, a second laboratory (DHI Denmark for Det Norske Veritas) was USCG accepted. More labs will be joining soon, which will accelerate the market development.

Not all makers have delivered input for the actual HANSA market survey, but Tab. 2 shows clearly that some makers until now have achieved a strong market share: Approximately 90 % of deliveries and orders have been acquired by only six of more than 35 makers.

This does not mean there would be no room for others and even newcomers. In particular the retrofit demand wave and the expected bottleneck situation in supply capacity could create new champions, especially if they would provide leading edge and reliable treatment processes, taking into account the meanwhile more obvious challenges and lessons learned. On the other hand, many makers told HANSA they would expect further makers to vanish during the next two years and also broader consolidation in the BWT market.

BWT technology challenges and makers’ responses

Technology

Ballast water treatment is in principle facilitated by two types of process steps:

a physical solid-liquid separation, which should already remove most larger organisms, and a disinfection step, using chemical reactions or physical effects, such as UV radiation, pressure pulses (cavitation), ultrasonic treatment or (inert) gas injection. Most offered systems feature both process steps, some even combinations of different disinfection means for enhancement.

The physical separation is mainly done by filters with mesh sizes of 10-50 m. The separated solid phase, containing the larger species in the filter back wash, is allowed to be flushed overboard in the ballasting area, but not in the de-ballasting area. That is why the separation step is usually bypassed in case the ballast water is treated also during the de-ballasting operation. Although filters are commonly used, special attention should be given to the selection of filter type, since under high biological and sediment load some filter types may be prone to clogging.

The different disinfection paths, namely chemical treatment or physical destruction (e.g. by UV radiation, cavitation, ultrasonic treatment, heat or deoxygenation), do all have their stronger and weaker features. The main issues are as follows:

All BWT processes in which chemicals are added (e.g. ozone or chlorines) normally require neutralisation or a specific retention time before discharging the treated ballast water in order to meet the IMO standard, which limits total residual oxydants (TRO) to less than 0,2 mg/l in the effluent. This is because some compounds are generated (by-products) during the reaction, which are often stable or do have a half-lifetime of several hours. It is evident, that reliable real-time effluent analytics and additives dosing is a necessary key feature.

Some makers are presenting long-term studies in order to prove such oxydant by-products would not lead to accelerated corrosion in ballast water tanks, others offer an optional process step to insert inert gas (e.g. nitrogen) to suppress tank corrosion. This consideration also applies for chemical processes triggered by electrolyse, which require a certain salinity of the water. Thus, frequent ballasting operation in fresh or brackish water needs special consideration and possibly additives for chemical and electrolytic processes.

Physical destruction processes do not require chemical storages, handling of additives or residual control. UV treatment lamps are in general energy consuming. They have the highest germicidal efficacy when radiating wave lengths between 240 and 280 nm (UV-C). UV lamps with low internal pressure (LP) have a narrow wavelength spectrum (peak at 254 nm), but energy consumption is 30–50 % lower compared to medium pressure (MP) lamps, which provide a more polychromatic UV output for a better cover of the entire germicidal wavelength curve in the aforementioned bandwidth. MP lamps are usually higher powered and more compact, which means fewer lamps can do the same job with a smaller footprint. Several systems now have a dimming function that reduces energy consumption in better water conditions. For the treatment of poor water quality at high flow rates MP lamps are often considered to be the most effective choice so far. The cleaning process of the UV lamps is a key quality factor of a UV-based system.

There are some processes which use shear forces generated by cavitation or ultrasonic pulses to destroy the organisms, mostly in the absence of a physical separation step or as further enhancement (add on) to chemical processes.

A special approach is the removal of dissolved oxygen (Deoxygenation) from the ballast water by low oxygen inert gas injected in venture nozzles (N.E.I./VOS process), which leads to asphyxiation of organisms and reduces the corrosion in the ballast water tanks due to the removal of oxygen at the same time. This process is more suitable for large ships (tankers) on longer voyages, since the disinfection effect will be reached only after two to four days of treatment.

Challenges

Insiders estimate that only about 25 % of the already installed 450 BWT units on ships are operating more or less regularly today. Hence, the experience for the different processes is still limited. However, the challenges from daily operation become more and more evident. The variety of water conditions (salinity, temperature, pH, turbidity or transparency for UV light), the different quantity and kind of organisms in different regions, in particular the different physical properties (e.g. filtration characteristics / »softness«) of species in fresh and sea water, and – one of the biggest problems – the heavy sediment load in many coastal waters have created headaches for BWT systems.

Many major ports (Shanghai, Rotterdam, Bremerhaven etc.) are located in river estuaries, where brackish or almost fresh water forms the ballast uptake. The high content of solids taken up in river estuaries increases the pressure drop of filters quickly and requires effective cleaning processes. But it is not the only filter challenge: In these waters also live different organisms that have a »softer« body and tend to pass fine mesh filters of 40-50 even when they are larger than 100 . These species are an unexpected challenge also for the following chemical or physical treatment steps. Electrolysis systems need extra salinity infusions to work and become very energy-consuming in fresh and brackish waters. UV systems suffer from lower UV transmittance in fresh water as well as from the usually higher turbidity in coastal waters.

But also the water temperature of the region is an important factor: While electrolytic technology functions optimally above 15° C seawater feed, performance of hypochlorite generation is reduced at water temperatures between 10–15° C and most such technologies do not function at all below 5° C. Below 10° C the production of oxygen predominates chlorine and below 5° C the formation of chlorine hydrate significantly reduces the efficiency of the generator. Colder temperatures on the intake side also considerably increase the power demand of electrolytic BWT systems. Another challenge is the automatic operation of systems, which have to inject chemicals dependent on the actual water intake or effluent status. Although there are accurate sensors for the relevant parameters available, those sensors mostly have been developed for land-based use and thus still have to prove their reliability and fatigue under typical marine operation conditions such as vibrations, changing temperatures and corrosive atmosphere.

Makers’ update

HANSA asked BWT makers for their update information prior to this article. Tab. 3 provides an actual maker overview based on the received and publicly accessible information. Among the top twelve makers who have at least some 20 orders are three German (RWO, Mahle, GEA Westfalia), two Korean (Panasia, Techcross), two US (Hyde Marine, N.E.I.), two Norwegian (Optimarin, OceanSaver), one Swedish (Alfa Laval Tumba), one UK (Severn Trent de Nora), and one Chinese (Qingdao Headway). Panasia, Alfa Laval, Techcross, and Hyde Marine have the highest market share, followed by Optimarin and RWO. Of those top six makers five use mechanical filtration as first process stage, four processes use UV (one with additional »advanced oxidation«) and two processes are »electrochlorination« (EC) or »electrolysis« type (one without filter stage). In the total list the distribution UV vs. other processes is approximately 50:50.

A look into the orderbooks does not unveil a clear trend towards a certain BWT technology. Having the variety of ship types, water conditions and trades in mind, the author predicts that there will remain »many viable ways to Rome«. And, as mentioned above, the upcoming shortages of supply will definitely give other quality makers and late entrants the opportunity to challenge the current market leaders. A key element for market success will be the availability of worldwide rapid service, especially during the first time with larger troubleshooting demand.

Several makers have used the time of lower than expected demand to enhance their systems or even come out with new and partly complementing systems:

Alfa Laval launched the third generation PureBallast 3.0, claiming a step change in weight and space demand compared to the earlier generations. Mahle (OPS) feels their original decision to work with two-stage filtration has been much confirmed by actual reports about filter problems. RWO is going relatively strong with its CleanBallast system (filtration and electrochemical disinfection). Wärtsilä now offers alternatively a UV and an EC system, while Hyundai Heavy Industries decided for the same strategy. Siemens has changed the name for its filtratio n / EC system (based on the proven anti-fouling system Chloropac) to SeaCure. DESMI has announced a second process now without ozone step (RayClean). French company Bio-UV appears with a new filtration and MP UV product, and the Canadian Trojan Technologies offers a compact filter and UV system in one reactor vessel, claiming less UV problems with turbidity.

The more descriptive USCG approval tests, which cover a broader range of water condition scenarios, will contribute to make process technology dependent deficiencies in BWT performance more visible and will also motivate (or force) makers to develop solutions to close identified performance gaps. In any case, ship operators should carefully analyse possible future trade profiles as well as ambient and water conditions to be expected for their ships and compare them with the pros and cons of the different technologies before selecting a BWT system.

Port State Control:

Still the unknown factor

The fact that the International Maritime Organization will likely agree on a three-year »test period« without Port State Control (PSC) sanctions, after entering in force of the Ballast Water Convention, illustrates there is actually no accepted and safe base on which PSC for BWT systems function could be performed, neither technical (fast analytics) nor procedural.

Worldwide there are only a handful of companies working to develop reliable, quick and portable (»seaworthy«) analysis methods and equipment. Once such equipment would be available, first experiences on board would have to be made (a first prototype test was announced to begin in spring 2013). A fundamental question is whether each individual ballast water treatment plant would have to demonstrate its proper function before starting in port ballast discharge or whether a more certificate / regular based inspection method will be chosen for Port State Control.

Latest insider opinions assume that the latter way will prevail. Ship operators hope that the rules and procedures during the three-year period are made clear and uniform enough to avoid discussions with local authorities and that »stamp charges« – as just experienced for the first control issues regarding the MLC – will not apply. The future handling of PSC analysis and enforcement is still the unknown factor for ship operators.

Michael vom Baur