On account of strong fleet growth, analysts maintain a bearish stance on the LNG shipping freight rate outlook for 2017.

Given the mounting pressure on freight rates and continuing fleet growth over the next two years, excess vessel supply will reduce only gradually with the re[ds_preview]covery in rates pushed back to the latter part of next year, according to the latest edition of the LNG Forecaster report published by shipping consultancy Drewry.

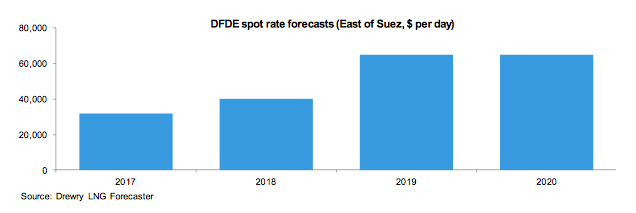

The analysts at Drewry maintain a bearish stance on the LNG shipping freight rate outlook for 2017 on account of strong fleet growth which is expected to be around 13%. The movement in rates has so far been in line with Drewry’s expectations, as rates have been falling since the beginning of year. The spot rate for dual-fuel diesel-electric (DFDE) vessels (East of Suez) is currently around 26,000 $ per day, compared to 37,000 $ per day in the beginning of the year, a fall of 30 %.

»The tremendous weakness observed recently in the freight market highlights the ample vessel supply. We are anticipating two years of aggressive fleet growth with supply expected to expand a further 9% in 2018 which will extend the period of weak freight rate development into next year,« said Shresth Sharma, Drewry’s lead LNG shipping analyst.

He therefore does not expect rates to start recovering until the end of 2018 when several new LNG trains from the US are expected to be operating at full capacity. »As a result, we have trimmed down our forecast for average spot freight rates in 2018 to 40,000 $ per day from the earlier expectation of 50,000 $ per day,« added Sharma.